With the continuous deepening of digital transformation, the demand for ERP systems in enterprises is gradually upgrading. The SAP ERP Public Cloud 2502 version launched by SAP further meets the needs of enterprises.

In terms of financial management, version 2502 mainly focuses on agility upgrades and compliance reinforcement, and has launched multiple strategic level feature updates and optimizations.

Based on our understanding, we are now interpreting the upgrade of SAP ERP Public Cloud 2502 in financial management, aiming to provide practical and feasible guidance for your system optimization and business process improvement.

Now, a time limited access feature for external auditors has been enabled for the following applications to restrict the data that external auditors can access.

● Create an address. List of Pre declaration Forms for Output/Input Tax (s_ALR_87012359)

● Create pre declaration form for output/input tax (s_ALR_87012357)

● EU Sales List for Data Medium Exchange (DME) Format (N_P00_07000221)

● Tax Posting for Management Suggestions (FOT_TXA_MTP)

● Tax declaration reconciliation (F2096)

● Tax reconciliation account balance (F2095)

To activate this feature, you must use the ‘Configure Universal Audit Framework’ application to create a ‘Universal Audit Filter’.

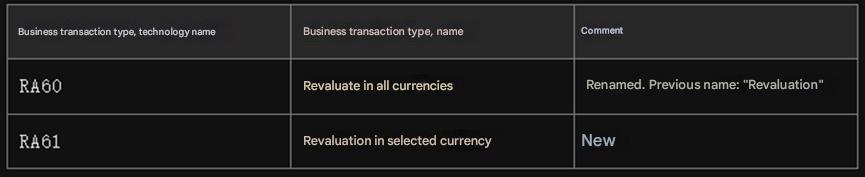

The new “Asset Revaluation Posting” application (transaction code F7775) introduces a graded currency management mode, allowing you to manually post revaluation. Support enterprises to choose between global multi currency linkage revaluation or independent revaluation based on business needs.

By adding the transaction type “Revaluation in Selected Currency” (Business Catalog SAP∝N_BC_AA_REVAL-PC), the system can accurately adjust the asset value of the designated ledger, avoiding interference from the group’s hard currency fluctuations on local accounting. This feature is particularly suitable for differentiated processing scenarios between local compliance reports and group consolidated reports of multinational enterprises.

Add the “Maintain Asset Revaluation Index” application (F8119), which supports regular or irregular updates of asset revaluation parameters based on external indices (such as officially released economic indicators). You can assign activated index values to specified assets, and the system will automatically calculate and post the revaluation amount. This feature simplifies the asset valuation process in a multi currency environment, especially suitable for market scenarios with frequent fluctuations in inflation rates.

Add AI driven depreciation code explanation function, supporting users to quickly obtain natural language explanations of the impact of depreciation codes on asset value. This feature not only simplifies the understanding of complex depreciation rules, but also serves as a supplement to traditional technical documents, enhancing the efficiency of financial personnel’s insight into changes in asset value.

You can call the AI’s explanation function in the following steps of the “Manage Fixed Assets” application (F3425):

● Select any fixed asset master data and click>to enter navigation details.

● On the “General Parameters” tab of the “Evaluation” view. Here, you can click on the link for a specific depreciation code and select the “Explain Depreciation Code” link in the pop-up window.

To optimize system integration capabilities, the newly added FHIR V4 API “Fixed Assets – Master Data” (APIFHIR XEDASSET) supports reading, creating, and modifying operations on master and sub asset records. This API will replace the soon to be abandoned SOAP interface, provide a more efficient RESTful architecture, and support asynchronous processing mode, helping enterprises seamlessly integrate with external systems or automated processes while ensuring compatibility with future versions.

Optimize the reconciliation function of units within the group, and add the ability to display differences in layers and batch close accounts:

● In the “Manage Reconciliation Closure” application, a new double column comparison between “Latest Closing Variance” and “Closing Variance” has been added, supporting dynamic tracking of reconciliation variance changes;

● By using the ‘Plan Reconciliation Closing Job’ application, it is possible to batch process over 50 pairs of closing tasks, avoiding performance bottlenecks.

This upgrade strengthens the consistency management of cross entity financial data and improves reconciliation efficiency.

Add flexible invoicing voucher posting rule configuration function for complex sales scenarios. Users can dynamically define the allocation logic between sales invoicing accounts and cash settlement accounts in “Automatic Account Determination”, and support flexible mapping of general ledger accounts based on conditional tables (such as customer grouping or transaction types). This feature helps enterprises achieve tax compliance and multi-dimensional accounting classification, while reducing manual intervention.

Starting from version 2502, the reclassification of the balance sheet will default to the write off posting logic, and relevant vouchers will be recorded on the write off date, replacing the original incremental posting logic. New customers will automatically activate this feature, while existing customers will need to complete data migration through the ‘Migration of Balance Sheet Reclassification Posting’ task. This enhances the transparency of financial statements and audit traceability, while reducing the complexity of accounting adjustments.

Added deep integration functionality with SAP Green Ledger, supporting enterprises to synchronize financial data and carbon footprint information through the SAP BTP platform. This function can collect real-time carbon emission data from business activities and link it with financial accounting to provide accurate basis for sustainable development reports. Enterprises need to achieve data interoperability through configuring connectors and follow the SAP Green Ledger management guidelines to complete end-to-end deployment.

In the joint production mode, the cost allocation rule has added support for “planned output quantity” (PP5) and “actual received quantity” (PP6), covering production to order (MTO) and production to inventory (MTS) scenarios. Previously, MTS only supported manual input of equivalent (PP1), but this expansion has improved the automation and accuracy of cost allocation, especially for discrete manufacturing and process industries.

On the SAP Fiori Quick Launch Pad, you can search for general ledger account numbers. The detailed information of this general ledger account is displayed in the “Display Operations General Ledger Account” application. As a general ledger accountant (business template role: SAP_BR_GL_ACCOUNTANT), You can view the master data of the operational general ledger account.

Add management accounting data destruction objects (such as CO-UNIV.ALOC_UPLD_DESTRUCTION), support clearing redundant allocation data, and ensure data storage compliance. At the same time, the audit data restriction function for tax applications (such as value-added tax pre declaration reports) can restrict external auditors’ data access permissions by period and company code through a “universal audit filter”, reducing the risk of sensitive information leakage.

Add partial advance payment posting function in the scenarios of customer collection and supplier payment. You can enter a partial amount in the “Allocated Amount” field of the “Post Receipt” or “Payment Clearance” application, and the system will automatically keep the original prepayment request in an outstanding status until the remaining amount is settled. This feature supports linkage with invoice references to ensure the integrity of the payment chain and avoid the risk of accidental overpayment.

For newly launched customers, the standard hierarchical structure of the cost center will serve as the default global hierarchical structure to unify the cost allocation logic under the organizational structure. Existing customers can still use the traditional collection group pattern, but it is recommended to gradually migrate to a global architecture to improve data consistency. This improvement simplifies the configuration process of multidimensional cost analysis and provides a standardized framework for group level cost control.

The financial module of version 2502 has attracted many upgrades and enhancements. Through currency grading revaluation, dynamic index correlation, master data API standardization and other capabilities, your enterprise can significantly improve the accuracy of cross-border asset value management, while reducing the technical liabilities of system integration.

In addition to financial management, SAP ERP Public Cloud 2502 version also has many highlights and updates in AI new technology, R&D management, supply chain optimization, sales support, automation, and more. We will introduce them one by one later, please continue to follow us!

As a staunch supporter of SAP ERP public cloud, Acloudear is committed to providing you with the most cutting-edge and suitable solutions, helping your enterprise continuously advance on the road of digital transformation!

This article "Multi currency revaluation x AI analysis x carbon data linkage, Acloudear network deeply decodes SAP ERP public cloud 2502 financial innovation" by AcloudEAR. We focus on business applications such as cloud ERP.

Scanning QR code for more information